Santa Monica, West Hollywood, Culver City, and Malibu Will See Higher Increases

Starting April 1, Los Angeles County residents will see a slight uptick in sales tax, and no, it’s not an April Fool’s joke.

The countywide sales tax will increase by 0.25%, bringing the rate in most areas from 9.25% to 9.5% all over Los Angeles County. The change stems from the passage of Measure A in the November 2024 election.

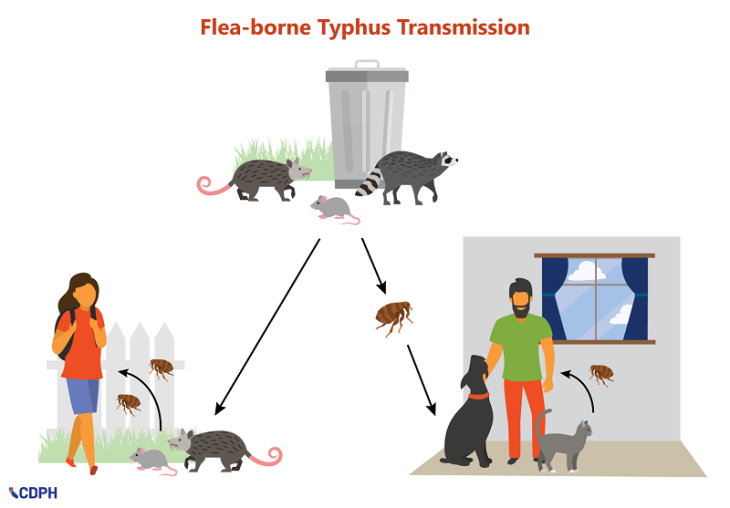

Measure A repealed the previous 0.25% tax implemented under Measure H and replaced it with a 0.5% countywide tax to fund expanded homelessness prevention programs, housing initiatives, and support services. Unlike previous measures with set expiration dates, Measure A’s tax increase will remain in effect indefinitely unless repealed by voters.

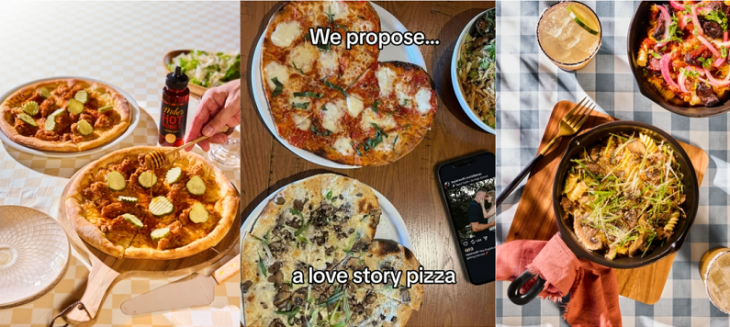

Voters found Measure A’s arguments compelling enough to pass this increase. Because some local municipalities have varying base sales tax rates, the impact of the new increase will differ by city. In some areas, shoppers may see sales tax rates above 10%.

City of Compton 10.250% to 10.750%

City of Culver City 10.250% to 10.500%

City of Inglewood 10.000% to 10.250%

City of Malibu 10.000% to 10.250%

City of Santa Monica 10.250% to 10.750%

City of West Hollywood 10.250% to 10.500%